The Not-So-Big Garden Center: Being Right About Demographics

The January 2006 issue of Lawn & Garden Retailer included the annual “Industry Leader Forecast” article, and I was flattered to be included in the forecasting group. As 2006 draws to a close, I revisited my predictions in light of the latest consumer research from Kip Creel of nQuery and the experiences of my own customers throughout the past year. I usually like being right; in this case, I’m both right and concerned. First, let me summarize the industry as I saw it at the start of the season.

- Customer count is down or flat; average sale is flat.

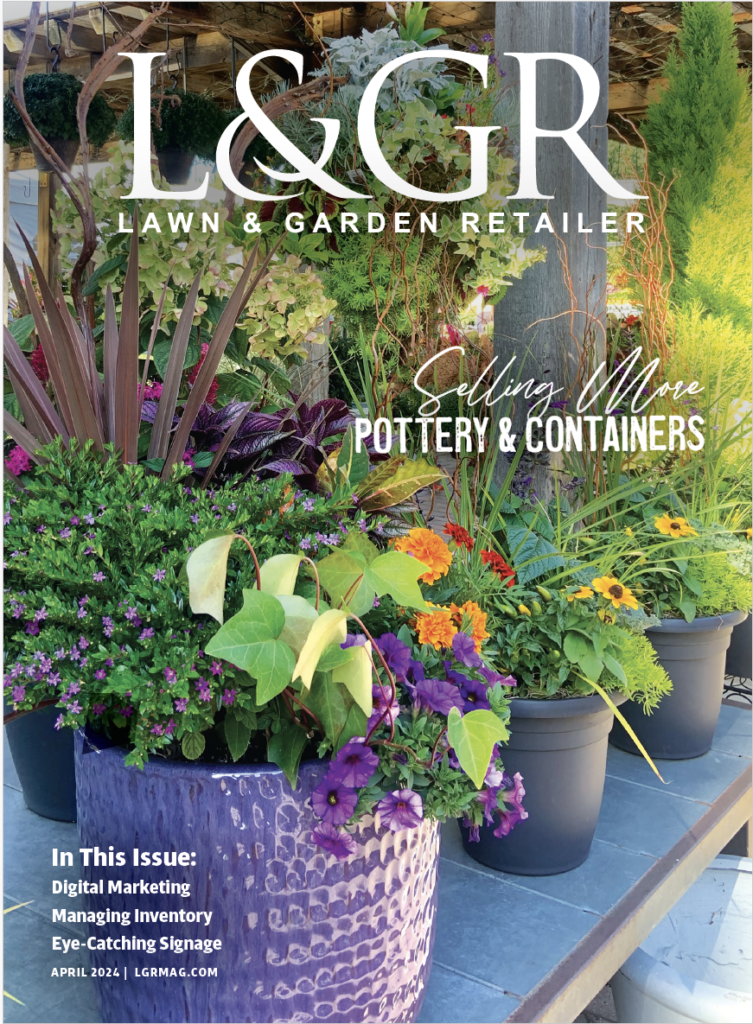

- The rise in container plants for use throughout the garden should have told us more; perhaps it should have alerted us that diverse consumer groups (i.e., the Baby Boomers, Generation X and Generation Y) had already changed gardening.

- We should have already read the continued demise of flat sales and the rise of 4- and 6-inch container sales as a demand by these time-starved consumers for immediate gardens.

- We should have already paid attention to the fact that every mass merchandiser has managed to create a gardening department to sell everything in the category successfully, with the possible exception of live plants.

- While we were paying little attention to the Boomers, they began a steady migration to other pursuits: travel, caring for elderly parents, supporting adult children, moving to smaller living spaces and, ultimately, gardening less.

- To add insult to injury, we have written off the next generation of gardeners as mass-merchandiser shoppers. We gave those uneducated, unappreciative young folks to the big boxes.

My Predictions

I summarized the industry’s situation in one sentence: “So, here we are: the Boomers are abandoning us, and Gen-X/Gen-Y don’t want much to do with our product.” On the basis of that collection of observations, I made five predictions. These predictions are based on the facts that first adopters will:

- Get real familiar with demographics. They’ll get to know their customers and potential customers through surveying and focus groups, and they’ll respond with new, branded products.

- Find ways to make a smaller retail shopping area more conducive to the time-starved consumer’s needs.

- Develop garden planting and maintenance services as in-store products and actively promote those “products.”

- Change their packaging from flats to 4- and 6-inch (and bigger) material and offer those larger sizes earlier in the selling season.

- Develop a communication strategy to invite the young, non-gardening generation to the store for products, not process.

Every aspect of those predictions manifested themselves in every on-site audit I have Á conducted this year. Retailers reported all the situations relating to this demographic schism. There was particular emphasis on customers’ interests in planting services and immediate gardens and their lack of interest in the process of gardening; seminars on pruning were very poorly attended.

For an industry for which customer service has been defined as teaching the Latin intricacies of plant identification, diagnosing insects and diseases, and waltzing the customer all over the store to locate just the right plant(s) from diverse production-based product categories, the tectonic plates have shifted. These customers don’t want questions answered by Latin-speaking staff; they don’t even want to ask questions. They just want a collection of yellow and blue container gardens delivered in time for a dinner party on Saturday night. And, as I also learned from nQuery, customers want that even more.

Generation Case Study

Let me introduce you to Manny. Manny showed up to assist me with my audiovisual equipment at the recent PANTS show. Being a rogue MAC user, I always like to have a techie around. Manny sported a New York Yankees baseball cap (backwards) and a long-sleeved, black t-shirt that I’m sure camouflaged tattoos from his corporate boss.

Manny is 28 but no ordinary techie; he is head of audiovisual services at the new Atlantic City Convention Center and just bought his first house. Maybe you recognize Manny; he is Gen-Y. As I ran through my PowerPoint presentation, Manny asked, “You know about gardens?” I explained that I work in the industry, and yes, I do know about gardens. I might as well have dropped a nickel in a slot; Manny was off on a confessional about his new house and the yard that had him so confused. He had no idea what to do; he just wanted to find someone to make the back yard look better. More than that, he confided that what he really wanted was to be able to entertain his friends while they all watched football in the back yard.

Manny wanted a sports entertainment area in his back yard. I suspect that included a covered area for a big-screen TV and a place to cook and serve food and make drinks. Maybe it even included some plants. And Manny could afford it. I couldn’t help but fantasize about Manny’s visit to his local garden center.

It was later that day that Kip Creel of nQuery painted a research picture of Manny. Here are the “Manny” (aka Gen. Y representatives) high points from Creel’s latest research:

- When you ask Manny to name garden stores, he or she says Home Depot and Lowe’s.

- When you ask Manny to describe traditional garden centers, he or she says, “a place where old ladies shop.”

- When you ask Manny where he or she gets outdoor living information, he or she says HGTV, and that’s defined as “before and after.”

- When you ask Manny to describe what he or she wants from outdoor space, he or she says “relaxation, entertainment and sanctuary.”

- When you ask Manny to describe gardening, he or she says he or she wants products, not process.

So with Manny showing up both in person and research, I was riveted by the implications and reminded of my earlier industry overview and predictions.

What Does It All Mean?

One of the “first adopters” (the first group to try something new) to show the importance of demographics is Bachman’s in Minneapolis, Minn. In a market where new stores like Tangletown Gardens and Noble Landscape and Garden Center compete with proverbial giants like Gertens, Pahls Market, Malmborg Garden Center and Highland Nursery, Bachman’s spreads its successful haze all over the market, from floral to outdoor to furniture.

On the basis of extensive focus groups, Bachman’s has opened its Wink department to go after the younger market. Opening this department was recently described as the process of consumer research, store design, brand modification and product selection. And a visit to Wink confirms the rumors of traditional garden statuary decked out in neon colors. This is not your father’s Oldsmobile and definitely not “a place where old ladies shop.” Right next door to Wink, however, the Boomer can find all the traditional decorating items that have made Bachman’s famous. And the purple is still in sight, only now trimmed in a fashionable apple-green stripe.

And Wink is a small space that can be shopped efficiently by time-starved consumers of any age. Other stores have found that small space can be made to work. All of the not-so-big garden centers that have been featured in my 2006 contributions to Lawn & Garden Retailer have exhibited the plusses of spaces that are small enough to be kept stocked, staffed and clean.

Innovative Examples

At Lockwood’s Greenhouses, Hamburg, N.Y.; Bemis Farms Nursery, Spencer, Mass.; and Araujo Farms, Dighton, Mass., small stores have proven effective venues for new departments, branded products and in-store workshops that create products instead of educating consumers in processes. Tina Bemis’ customers leave her workshops with finished trough gardens or seasonal wreaths.

It was with some trepidation that Kenny Aruajo tested 4-inch tomato plants at the beginning of the selling season, abandoning for the first time six packs. Both customers and cash registers were happy. He’s now working on next year’s plan for even more 4- and 6-inch offerings at the very start of the planting season. Aruajo also dedicated a complete greenhouse to branded Proven Winners products with the complete brand support program that allows customers to make a buying decision quicker using silent sellers. Sales soared.

All of these stores have embraced the Web as a communication tool. All consumer groups, but especially Gen-X and Gen-Y, expect an active Web page the way consumers once relied on the phone for information. And what a plus! Stores can relieve the nagging problem of the phone at the register by putting so much of the information customers call about hours, directions, inventory, prices, and even planting and diagnostic questions right on their Web sites.

Before And After

But what about the issue of before and after? HGTV has trained this consumer group to solve complicated issues of fashion, home improvement, decorating and gardening in 30-minute segments. So how do we react at store level? The first opportunity is to revamp display gardens to illustrate various problem garden areas and solve the product with a complete product presentation.

At Schroeder’s Flowers, Green Bay, Wis., Connie Schroeder uses a set of “before” banners to illustrate an unadorned back yard. I imagine it’s pretty close to Manny’s “before” yard. She then places collections of products in front of a matching set of back yard banners to show customers how to use the space. The collection includes fountains, furniture and container plants. Everything in the “after” is a high-margin product not a time-consuming process.

All of these products can be delivered and installed by the store; this is no-shovel gardening at its finest. If Manny were her customer, she could show him furniture, a grill and the right spot to install the covered area for the wide-screen TV. Her landscape division could even build the covered area and install the plantings. Garden centers could use images of customers’ gardens that the customers bring to the store. These “before and after” customer queries could form the basis of a product-based workshop.

At Daisy Garden, Long Island, N.Y., a planting service is included in all of the company’s advertising and promotion, in-store and out. Tom Stemler explains he’s only responding to customer demand. His attractive direct mail piece says, “Due to overwhelming demand, we now offer planting service for all the products we sell!” Kip Creel would be pleased: a garden center responding to customer demand and making money off that response. When the demographic speaks, the successful garden centers listen. That’s a prediction you can take to the bank.

Videos

Videos